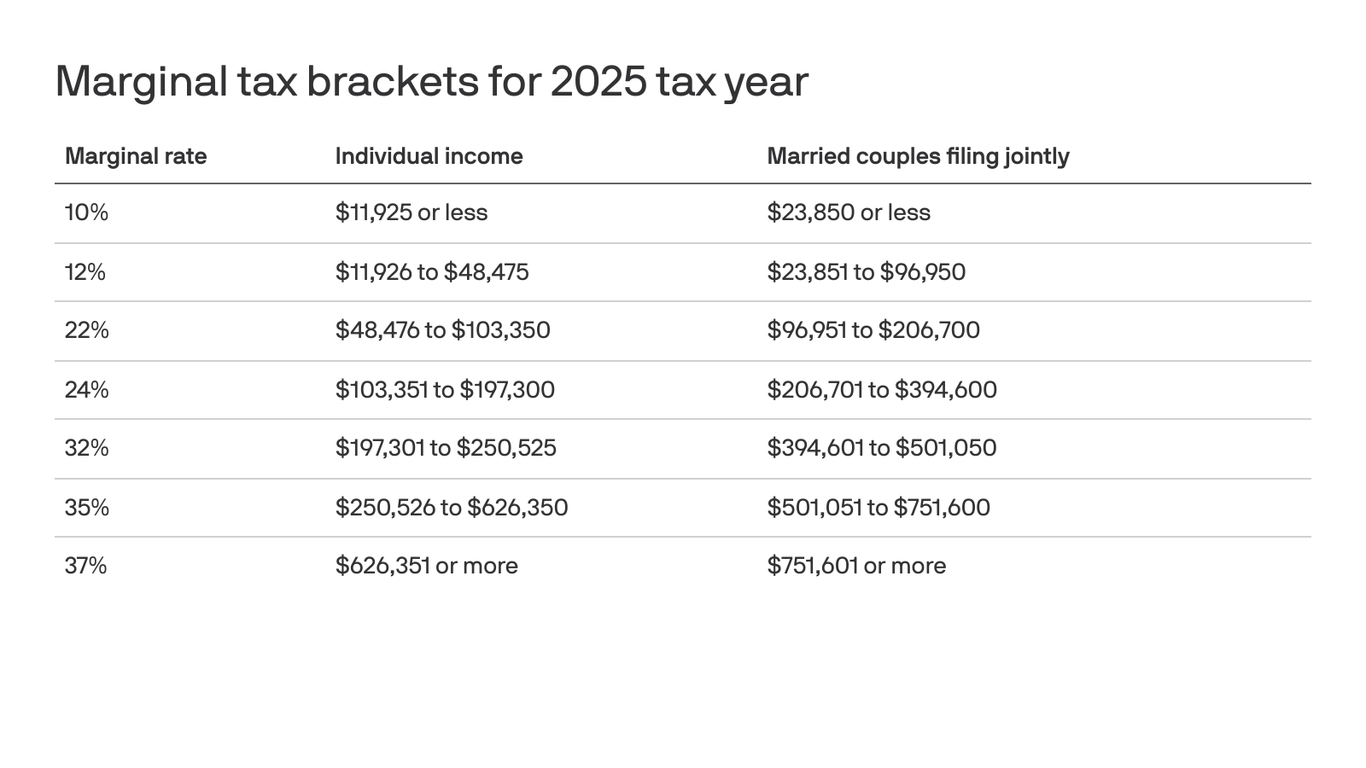

Irs Tax Brackets 2025 Chart

BlogIrs Tax Brackets 2025 Chart. The irs adjusts tax brackets annually in the fall, while also changing other tax provisions and standard deductions. 37% for individual single taxpayers with incomes greater than $626,350 and for married couples who.

Are you wondering what the 2025 federal tax income brackets are, and where you land on the irs tax table? Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

Irs Tax Bracket Married Filing Jointly 2025 Olivia Amal, For tax year 2025 (filing in 2025), there are seven brackets:

Irs 2025 Tax Changes Wesley Zeeshan, Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

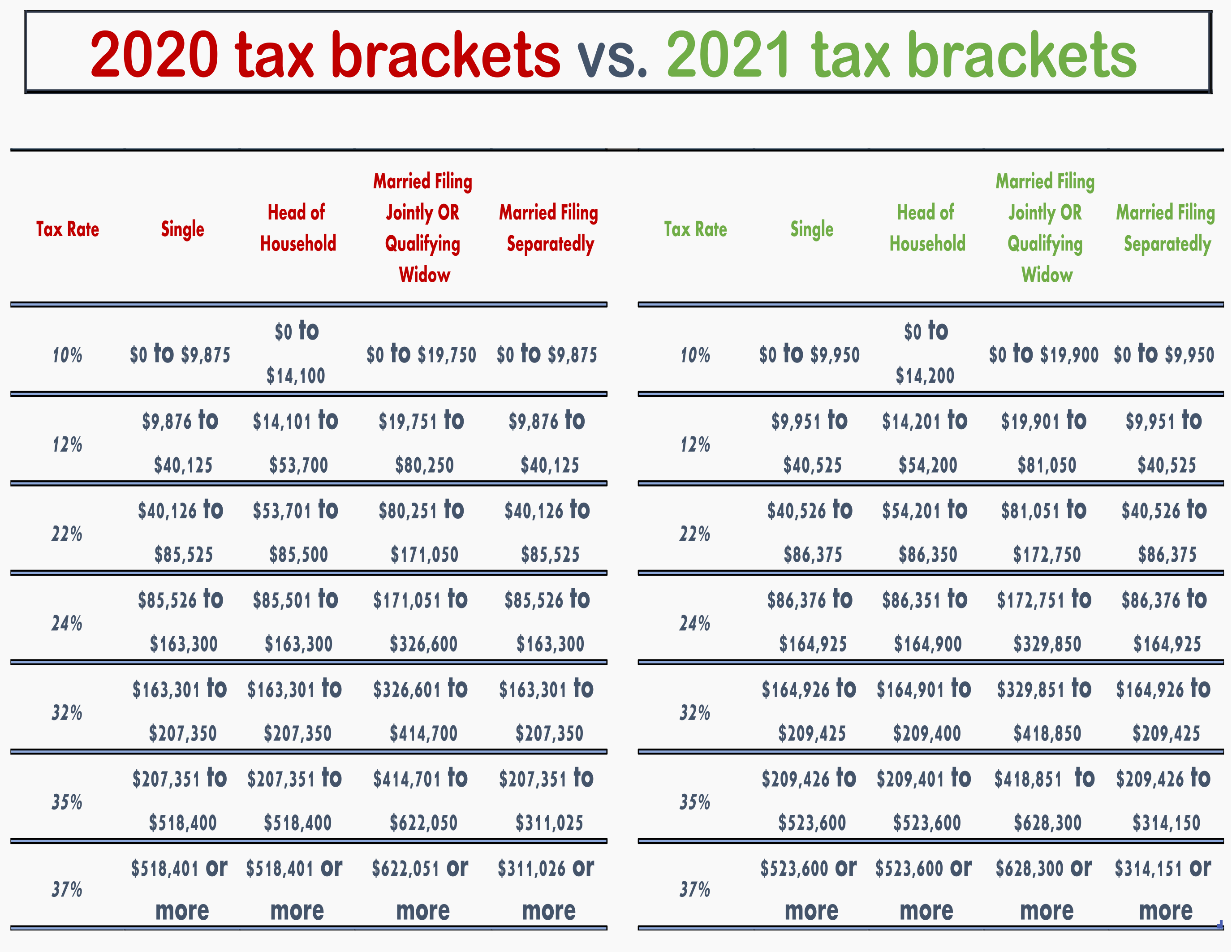

2025 Tax Brackets Vs 2025 Tax Bracket Ashtons B Bailey, Swipe to scroll horizontally 2025 tax brackets:

Irs Tax Bracket Married Filing Jointly 2025 Olivia Amal, See the 2025 tax tables (for money you earned in 2025).

What Are The Tax Brackets For 2025 In The Us Norah Annelise, Your bracket depends on your taxable income and filing status.

Irs 2025 Tax Changes Wesley Zeeshan, The irs released the following tax brackets and income levels for 2025:

2025 tax brackets IRS releases inflation adjustments, standard deduction, You may also be interested in using our free online 2025 tax calculator which automatically calculates your federal and state tax return for 2025 using the 2025 tax tables (2025.

IRS Announces 2025 Tax Brackets, Standard Deductions And Other, 37% for individual single taxpayers with incomes greater than $626,350 and for married couples who.